Global Mobility Gets Complex: Taxation Implications of International Assignments

On February 9, AmCham, in partnership with KPMG ACOR TAX, invited HR Professionals to a breakfast roundtable to discuss the tax considerations for international assignments to the USA & Denmark.

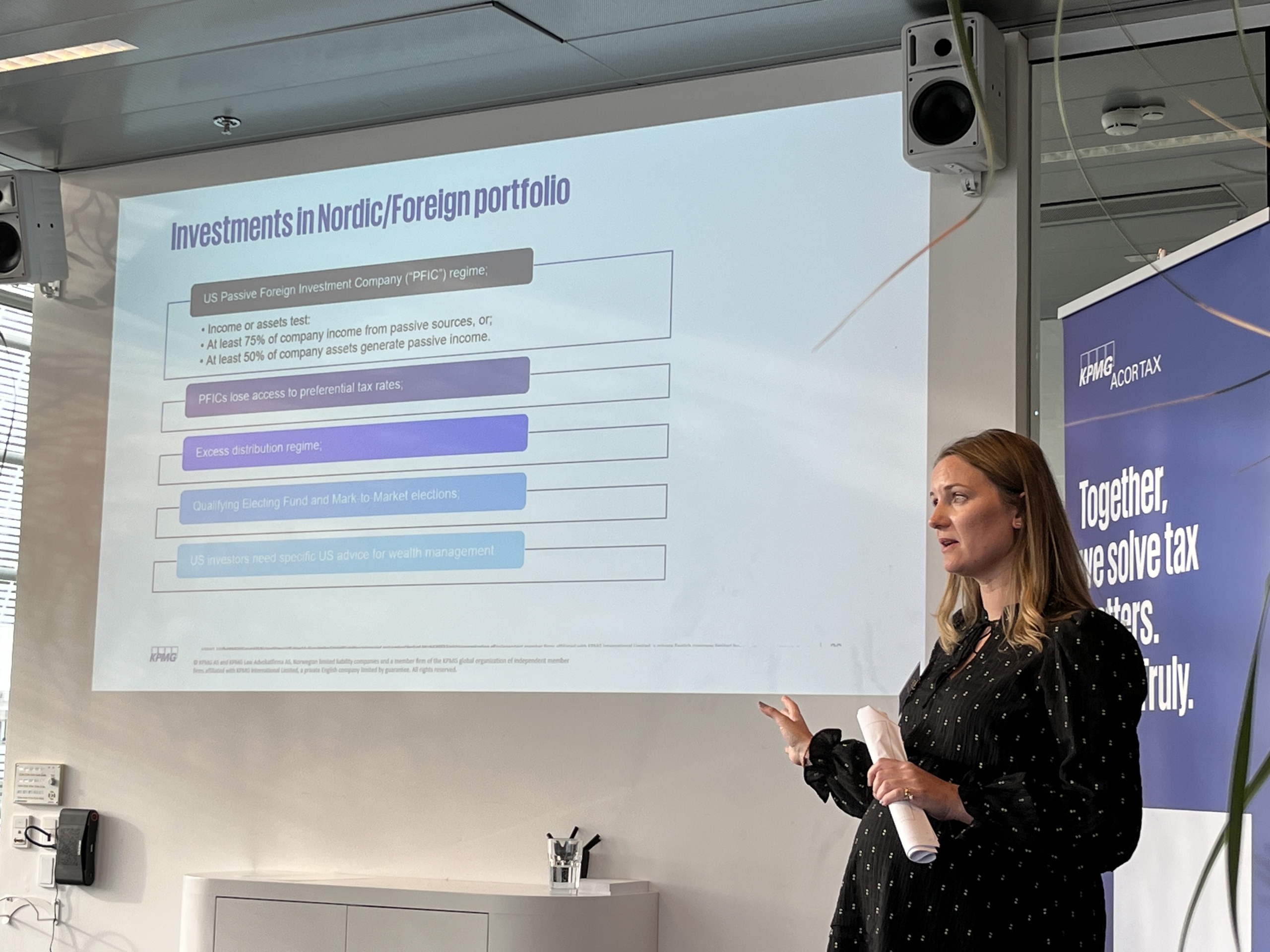

Expert speakers shared valuable insights on a range of topics of relevance for mobility specialists on the tax implications for employees – both in Denmark and the U.S.A.

Some of the topics included U.S. taxation basis, Social Security, payroll and withholding, bonus & deferred compensations tax implications, foreign tax credits, and pension plans & the US-DK Tax Treaty.

The key is to have employees consider these implications early, in order to make informed decisions on assignment packages, minimizing costs and ensuring compliance in both countries.